You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Investments For Those With Zero Experience?

- Thread starter Slyder190

- Start date

In the strictest sense of "paycheck to paycheck," I agree, but I wasn't surprised by this statistic:It was just said on the news that about 60% of all Americans now live paycheck to paycheck. That seems high to me. If it is true, thats depressing.

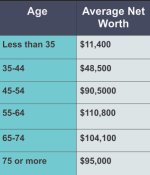

This is some abysmal saving. And except for the lowest income earners, it's not what you make: it's what you spend relative to what you make. Who will be richer in 20 years: a guy making $50k/year and saving 10% or a guy making $100k/year and spending $100k/year (if not spending MORE than that by going deeper into debt each year).

- Joined

- Mar 16, 2007

- Messages

- 25,912

Well, another thing to consider is that it says "net worth". Im pretty sure that includes your home too and other valuable assets. Im 52, so according to this my net worth would be around $90,000. That means that most people my age dont have much equity in a home at all.In the strictest sense of "paycheck to paycheck," I agree, but I wasn't surprised by this statistic:

View attachment 155066

This is some abysmal saving. And except for the lowest income earners, it's not what you make: it's what you spend relative to what you make. Who will be richer in 20 years: a guy making $50k/year and saving 10% or a guy making $100k/year and spending $100k/year (if not spending MORE than that by going deeper into debt each year).

You're right. Years ago I was in a bank and there was a poster of a Hawaiian scene. The advertisement? FOR A HOME EQUITY LOAN!!! I'm sorry, but if you have to borrow against your house to go on vacation, you're "retirement" is going to suck.Well, another thing to consider is that it says "net worth". Im pretty sure that includes your home too and other valuable assets. Im 52, so according to this my net worth would be around $90,000. That means that most people my age dont have much equity in a home at all.

- Joined

- Mar 16, 2007

- Messages

- 25,912

Man, thats terrible. Id cringe if I saw that. Some folks do it I suppose. Only way I would do it was if I was single and only had a year or so to live. No dependents.You're right. Years ago I was in a bank and there was a poster of a Hawaiian scene. The advertisement? FOR A HOME EQUITY LOAN!!! I'm sorry, but if you have to borrow against your house to go on vacation, you're "retirement" is going to suck.

"May the last check bounce"Man, thats terrible. Id cringe if I saw that. Some folks do it I suppose. Only way I would do it was if I was single and only had a year or so to live. No dependents.

- Joined

- Dec 24, 2005

- Messages

- 1,611

Well, another thing to consider is that it says "net worth". Im pretty sure that includes your home too and other valuable assets. Im 52, so according to this my net worth would be around $90,000. That means that most people my age dont have much equity in a home at all.

Banks and lending companies encourage home equity loans and the majority of home owners are taking out all the equity in their homes. I read the other day that the American's average credit card debit is $8,000... that's per card!!! Their saying that the average American have 4 credit cards which would be $32,000 of credit card debit.

Watch the wolf of wall streetReally appreciate everything single reply. Thank you. Now I know a starting point. Any books you trust anc recommend, even just to get me familiar? Thank you again.

- Joined

- Mar 16, 2007

- Messages

- 25,912

Yes, ive seen the stats on credit cards. With inflation at a 40 year high now I am afraid credit card debt is probably higher than ever. I got in a pretty good habit because my first credit card was back around 1989 or so, and it was an American Express. Back then their policy was that you pay off your debt each month and not carry a balance, so thats what I did. Later on I had another card where I did carry some debt, but it never got high. I still feel foolish now for paying interest on that. We just paid off our only car loan, it was only for about 2 years. We just have to finish paying off the house now. Hoping too much crap on our house doesnt need replacing. My plan was to sell it before we have to get a new roof and heater. We built it back in 08, so its about 14 years old now. These new roofs are junk. They are supposed to be 30 year shingles, but most of our neighbor's roofs only lasted half that at most.Banks and lending companies encourage home equity loans and the majority of home owners are taking out all the equity in their homes. I read the other day that the American's average credit card debit is $8,000... that's per card!!! Their saying that the average American have 4 credit cards which would be $32,000 of credit card debit.

The plan was to build another new home, but the price to build now is totally insane. So we are going to wait for things to normalize.

Banks and lending companies encourage home equity loans and the majority of home owners are taking out all the equity in their homes. I read the other day that the American's average credit card debit is $8,000... that's per card!!! Their saying that the average American have 4 credit cards which would be $32,000 of credit card debit.

This isn't necessarily bad if you understand interest rates and debt ratios. For example, if you can get a HELOC for 5% and use it to pay off your credit card debt thats probably at 25-30% interest, you are saving a ton. Also, if you are an investor and have a reasonable conservative investment that will get you 7-10% per year, by all means you take the 5% heloc loan and invest it, especially when the market is pulled back.

- Joined

- Mar 16, 2007

- Messages

- 25,912

The problem with most folks is that if the get a home equity loan and pay off their credit cards, they end up just building up even more debt on the cards again. In the end they have even more debt. Now they have credit card debt and a heloc.This isn't necessarily bad if you understand interest rates and debt ratios. For example, if you can get a HELOC for 5% and use it to pay off your credit card debt thats probably at 25-30% interest, you are saving a ton. Also, if you are an investor and have a reasonable conservative investment that will get you 7-10% per year, by all means you take the 5% heloc loan and invest it, especially when the market is pulled back.

You are correct about the heloc turning into more debt for people. But that's not a heloc problem, thats just a personal finance problem.Our mortgage rate is 2.85%, and we will pay it off early.

As for your 2.85% financing, why would you want to pay that off early? You EASILY can make double that interest rate in an I-bond ETF, and probably almost 4x that investing into a SP500 fund. Everyone's financial situation is different, but paying off low interest debt early is usually a common mistake.

- Joined

- Mar 16, 2007

- Messages

- 25,912

I don't like being in any kind of debt,especially when retirement is only a little over 10 years away. We don't really need the loan.You are correct about the heloc turning into more debt for people. But that's not a heloc problem, thats just a personal finance problem.

As for your 2.85% financing, why would you want to pay that off early? You EASILY can make double that interest rate in an I-bond ETF, and probably almost 4x that investing into a SP500 fund. Everyone's financial situation is different, but paying off low interest debt early is usually a common mistake.

- Joined

- Dec 24, 2005

- Messages

- 1,611

Really appreciate everything single reply. Thank you. Now I know a starting point. Any books you trust anc recommend, even just to get me familiar? Thank you again.

The Wealthy Barber by David Chilton is a good one for beginners. The Millionaire Next Door by Thomas J. Stanley and William D. Danko is another good one... Dave Ramsey's Complete Guide to Money

I'm 37 and my net worth is a little north of one million. I read the total money makeover by Dave Ramsey when I was in college, and I followed the principles. It works..

1. Never take out any debt other than mortgage

2. Buy an affordable house, and pay it off as soon as humanly possible. Once you pay off your mortgage, you can start saving nearly 100% of your net income... savings really start to add up fast. This is key - I paid my house off by the time I was 33.

3. Keep a budget and stick to it. Save all of your money after paying your mortgage, and keep it in an interest bearing account. Reinvest the money you earned (compound interest - like poster said above an ETF / index fund is one of the best options. I personally use ticker symbol SPY). I kept all my budgeted expense money in an envelope each month and never spent more than that. Ate cheap food, and very rarely ever want out for dinner.

4. Live within your means

5. Be the one that loans money to others... not the other way around. Rich get rich by saving and earning interest - poor get poor by borrowing money they don't have and paying interest, and living outside of their means.

Most self made millionaires still to this day drive Honda Civics, shop at Goodwill and live in a $150,000 house. Just need the right habits.. you don't need to make a high income to become a millionaire.

1. Never take out any debt other than mortgage

2. Buy an affordable house, and pay it off as soon as humanly possible. Once you pay off your mortgage, you can start saving nearly 100% of your net income... savings really start to add up fast. This is key - I paid my house off by the time I was 33.

3. Keep a budget and stick to it. Save all of your money after paying your mortgage, and keep it in an interest bearing account. Reinvest the money you earned (compound interest - like poster said above an ETF / index fund is one of the best options. I personally use ticker symbol SPY). I kept all my budgeted expense money in an envelope each month and never spent more than that. Ate cheap food, and very rarely ever want out for dinner.

4. Live within your means

5. Be the one that loans money to others... not the other way around. Rich get rich by saving and earning interest - poor get poor by borrowing money they don't have and paying interest, and living outside of their means.

Most self made millionaires still to this day drive Honda Civics, shop at Goodwill and live in a $150,000 house. Just need the right habits.. you don't need to make a high income to become a millionaire.

- Joined

- Jan 5, 2004

- Messages

- 320

There are so many ways you can make good money with only having a little. BuyingReal Estate is NOT one of them. And I am speaking as a high level professional. BUT, if you have the stomach, and you manage the risk, you can make as much as 12% on your money pretty easily with real estate without ever buying a house. Something that is VERY much in demand right now are gift providers (i.e. hard money). The way it works is you keep risk and regulation to a minimum by becoming a gift associate offering someone up to $10,000 to use at closing to help them get across the line on their purchase. You can charge as much as 12% for the usage and set a term response of either 30-30-90 days depending on the person, risk profile, and state regulations. Make friends with some realtors and then offer the service to their buyers. You would be surprised how many people will gladly pay you back $11,200 to borrow $10,000. The real money comes when you are doing a few of these loans every month.

But, you do need to check regulations where you live and make sure this is legal and within the real estate commission allowances.

Other than that, start with an app like STASH and fund it with a few thousand. Set it up to automatically invest every week a certain amount of money and then when you use the card to buy anything at participating public companies (think getting gas), you earn fractional shares of stock in those companies. It all adds up over time and if you are young enough, you can really do well getting your feet wet this way.

But, you do need to check regulations where you live and make sure this is legal and within the real estate commission allowances.

Other than that, start with an app like STASH and fund it with a few thousand. Set it up to automatically invest every week a certain amount of money and then when you use the card to buy anything at participating public companies (think getting gas), you earn fractional shares of stock in those companies. It all adds up over time and if you are young enough, you can really do well getting your feet wet this way.

Similar threads

- Replies

- 1

- Views

- 427

Popular tags

aas

aas testing

anabolic steroids

anabolics online

anabolid steroids

anadrol

anadrol drol tabs inj

anavar

anavar and winnie

body building

body building supplements

bodybuilder

bodybuilding

bodybuilding steroid test

clenbuterol

cycle

deca tren dosage

deca-durobolin

dianabol

dianabol and oxy

gear

hcg

hgh

motivation

muscle building

muscle mass

nandrolone

oxandrolone

pct

peptides

quality raw

raw steroid powders

steroid cycle

steroids

suspension

sust300

sustanon

test

test 400

test ace

test cyp

test cypionate

test e

test prop

testosterone

testosterone boosters

testosterone cypionate

testsuspension

tren ace

trenbolone acetate

Popular tags

aas

aas testing

anabolic steroids

anabolics online

anabolid steroids

anadrol

anadrol drol tabs inj

anavar

anavar and winnie

body building

body building supplements

bodybuilder

bodybuilding

bodybuilding steroid test

clenbuterol

cycle

deca tren dosage

deca-durobolin

dianabol

dianabol and oxy

gear

hcg

hgh

motivation

muscle building

muscle mass

nandrolone

oxandrolone

pct

peptides

quality raw

raw steroid powders

steroid cycle

steroids

suspension

sust300

sustanon

test

test 400

test ace

test cyp

test cypionate

test e

test prop

testosterone

testosterone boosters

testosterone cypionate

testsuspension

tren ace

trenbolone acetate

Staff online

-

Big AIFBB PRO/NPC JUDGE/Administrator

Members online

- dxteran

- dantes

- rb1013

- bigzzz

- Paul.uns

- bizzbtw

- dimethyl11

- johnjuanb1

- Shelby

- Kenster

- plane

- RBW

- Hulk69

- SOUR DIESEL

- Onidus

- FEELTHEDROL

- Jetsmets1

- DIRECT

- Lethalius

- hevi-head

- RaFa

- sandiego_2008

- qbkilla

- Mattyc241

- Ton1333

- Stayfit

- 3BILLS

- juiceddunk2.0

- jlf245

- Venstazz1

- b-boy

- blackjack

- steve0691

- Elvia1023

- Alzadosghost

- mexicanhombre

- Xplicit

- SABAGOY

- svenrpb

- QECon34144

- derzwerg

- biggerguns

- hazmat

- ALPHALIFEFITNESS

- Ranchhand

- Big A

- JJT

- PRorER

- Idra

- Maly

Total: 1,298 (members: 1,292, guests: 6)

Forum statistics

- Total page views

- 559,193,925

- Threads

- 136,046

- Messages

- 2,777,128

- Members

- 160,428

- Latest member

- commonplaceconsulting

.gif)